In 2017, Ozempic was approved for the treatment of type 2 diabetes. Fast forward a few years, and the drug has become hugely popular for its off-label use as a weight-loss medication.

This has caused equal amounts of controversy and concern. However, the drug is 100% safe, and its efficacy is obvious, as so many celebrities have proudly shown. But Ozempic isn’t just a celebrity drug; it’s one that is accessible to everyone, and its results can be transformative.

Why Ozempic?

Ozempic was created by Novo Nordisk and designed to mimic the body’s GLP-1 hormone to stimulate the production of insulin. While it fulfills this purpose and helps diabetes patients control their blood sugar, its side effects are what make it stand out.

The active ingredient in Ozempic’s is semaglutide, which creates a feeling of satiety. This makes those who take it feel “full”, and their appetite is suppressed. With limited other safe obesity medications on the market, Ozempic is naturally garnering attention. But let’s find out how much.

Polly evaluated the online sentiments of 11,154,381 people for one year, ending on March 22, 2024, to determine public opinion about Ozempic. This is what the results said:

Table Of Contents

Toggle- Why Ozempic?

- Almost Everyone Agrees — Ozempic Works For Weight Loss

- Concerns About Long-Term Use Are The Biggest Deterrent

- Where Are People Getting Ozempic?

- Is Prescription A Priority?

- Ozempic Prescription Skyrockets, Then Slides

- Where is Interest in Ozempic the Highest in the US?

- Over 65s are The Most Engaged In Ozempic Conversations Online

- Women Top Men In Ozempic Interest and Engagement

- A Weighty Debate

Almost Everyone Agrees — Ozempic Works For Weight Loss

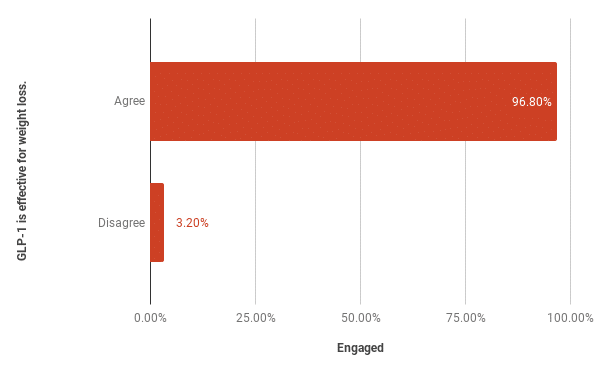

With over nine million prescriptions written for Ozempic and other similar obesity and diabetes drugs during 2022 alone and an increase of 300% in prescriptions between early 2020 and 2024, Ozempic’s efficacy isn’t really questionable. The chart below shows just how many people agree that it works.

Polly confirms that the primary active ingredient GLP-1 that’s used in Ozempic (and other weight loss and diabetes drugs including Wegovy and Rybelsus) has an almost 100% engagement rate. This means that 96.8% of people assessed agree that Ozempic is effective for shedding pounds.

The remaining 3.2% disagreed and either found that the drug didn’t work for them or expressed opinions about it not working – Polly’s results don’t disclose the reasons for their negative outlook. However, those who disagree may not have tried the drug for themselves, they may simply have expressed skepticism about its efficiency.

Concerns About Long-Term Use Are The Biggest Deterrent

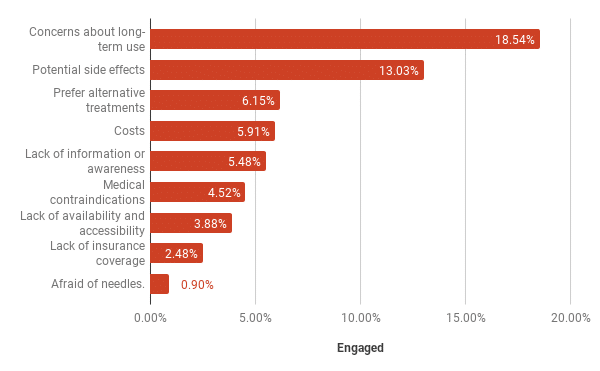

The consensus may be that Ozempic works for weight loss, but that doesn’t mean everyone wants to try the drug. The reasons for people not taking the drug are illustrated in the graph below, which is based on data from Polly, which sampled 5,168,081 people in the US over the course of one year (ending March 2024).

Although the side effects of Ozempic are supposedly limited to nausea, vomiting, diarrhea, constipation, and the so-called “Ozempic face”, where the skin wrinkles due to rapid weight loss, it’s concerns about the long-term use and how that will affect the body that put the highest number of people off taking the drug.

According to Polly, concerns about long term use are the most common reason people won’t use the drug, and concerns about potential side effects come in a relatively close second. A preference for alternative treatments gets 6.15% engagement, while the costs of the drug come in at 5.91%.

Lack of information or awareness is also a big deterrent, with 5.48%, while medical contraindications are just 4.52% behind.

Interestingly, despite the Ozempic shortage that led to Novo rationing its starter kits as diabetics could not obtain the medication, the lack of availability and accessibility is only deterring a small percentage of people (3.88%). Lack of insurance coverage limped in almost last at 2.48%, and a fear of needles puts off the least number of people, at just 0.90%.

Where Are People Getting Ozempic?

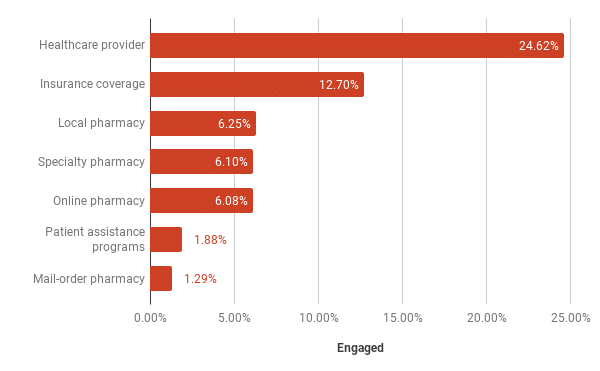

The high demand and limited supply of this drug have ensured that it’s available from many different legal sources. The chart below shows where people want to get Ozempic from.

Polly reveals that 24.62% of people want to get this drug from a healthcare provider, while just under half (12.7%) spoke about preferring to get it using insurance coverage. Local, speciality and online pharmacies were also mentioned as preferred places to obtain Ozempic, with only a few points of a percentage between them. If we combine these numbers, they’re just 5% short of healthcare providers, highlighting that pharmacies attract a lot of engagement overall. However, mail-order pharmacies were not favored as an option, coming in last with only 1.29%.

Patient assistance programs also had very limited engagement, possibly because the drug is not readily available in these programs as yet.

Is Prescription A Priority?

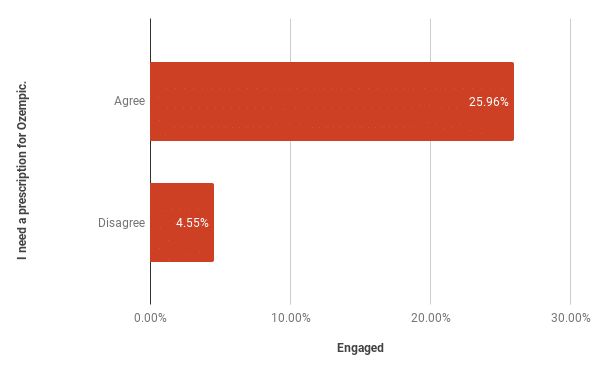

Getting Ozempic requires a prescription from a licensed healthcare practitioner. However, engagement levels regarding whether prescriptions differ online, as is evident in the graph below.

With 25.96% of those assessed talking about needing a prescription for Ozempic, the engagement levels far exceed the 4.55% who disagree.

According to Polly, needing a prescription for the drug is far more talked about than not, which is interesting when you consider just how many people are looking for it, especially in light of the shortages that occurred. Canada Health has now vowed to work with all stakeholders involved to monitor the supply and attempt to make it more available. However, there are currently no plans to make it an over-the-counter drug, not just in Canada but elsewhere around the world.

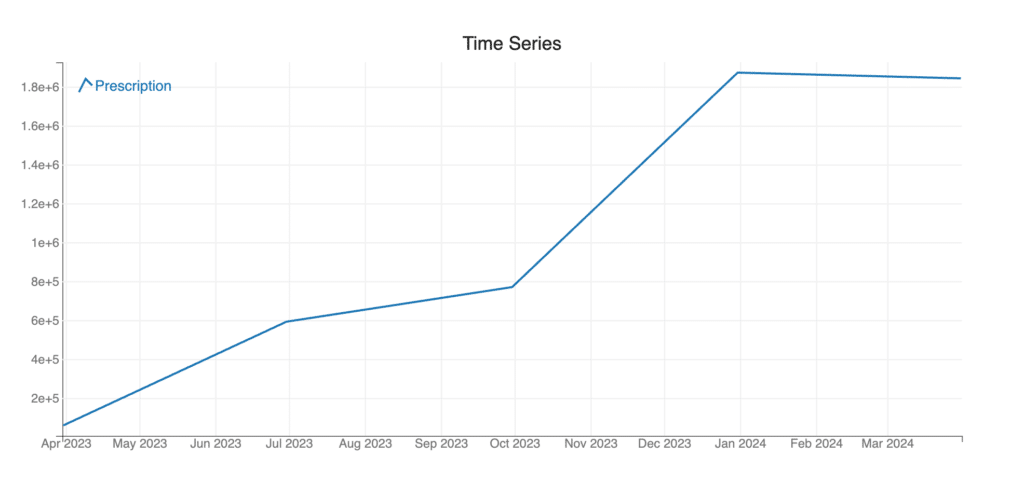

Ozempic Prescription Skyrockets, Then Slides

The discussion about the demand for Ozempic prescriptions naturally skyrocketed as they became more popular. However, as the graph below shows, it has plateaued and even started to decline somewhat. Let’s unpack what the graph reveals over the 12-month period.

Based on Polly’s results, it’s evident that from April 2023 to July of the same year, mentions of Ozempic prescriptions rose dramatically online. However, they slowed down a bit between July and October 2023 before massively increasing from October to January 2024.

From January 2024, mentions of Ozempic prescriptions started to decrease, and by March 2024, they had reached a slightly lower-than-peak plateau. However, when you consider that by March 2023, the hashtag #ozempic had already racked up over 600 million views on TikTok, perhaps the slight decline after the massive increase is showing that it’s becoming more mainstream as it becomes more widely available and the shortages slowly end.

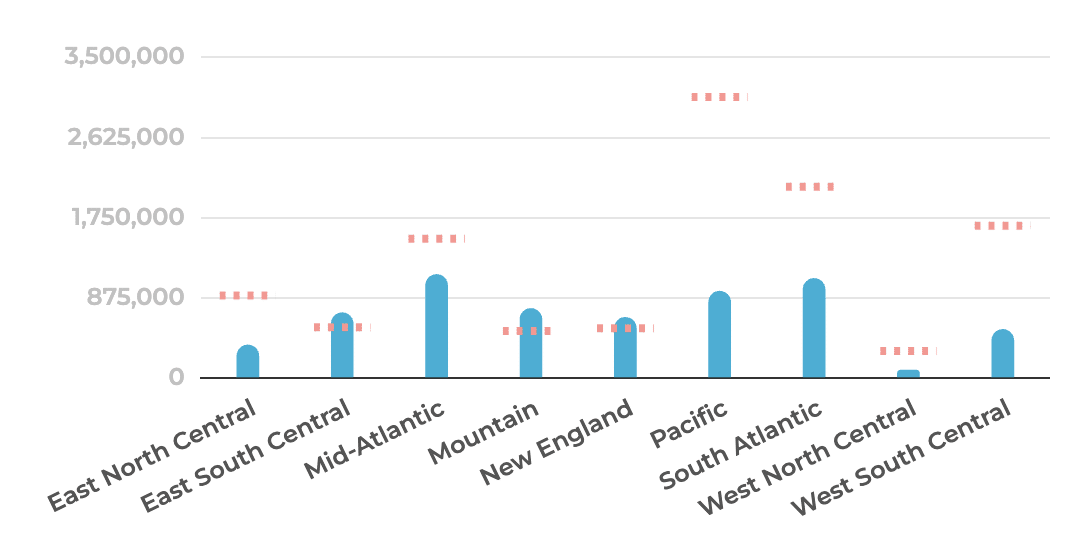

Where is Interest in Ozempic the Highest in the US?

It’s evident that there’s a huge amount of interest in Ozempic online, and the prescriptions are discussed extensively. The graph below gives us a better idea of where interest is at its highest in the US and how expected engagement versus actual engagement differs.

Polly shows that engagement levels in the mid-Atlantic are the highest overall, although the engagement levels were expected to be even higher. The South Atlantic is just behind the mid-Atlantic in engagement levels. But in this case, the expected level of engagement was even higher.

Looking at the regions that had higher engagement than expected, East South Central, Mountain, and New England all had similar levels of expected engagement and surpassed their expected levels. In contrast, those with lower engagement levels than expected were the East North Central, Pacific, and West North Central, with the latter’s actual engagement far below expectations.

West South Central gets a special mention as expected engagement is far higher than actual engagement, yet this region is home to states with the highest obesity rates in the U.S.

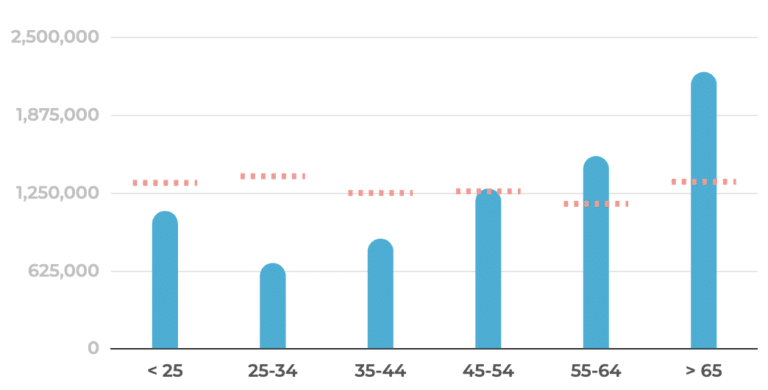

Over 65s are The Most Engaged In Ozempic Conversations Online

Polly’s analysis includes information about which age groups are engaging in conversations about Ozempic the most online. The graph below gives us a clear overview of this.

In the US, 41.5% of adults above age 60 suffer from obesity. Polly’s findings show that the engagement level of this age group is not only the highest but also well over the expected level. The engagement levels of those between 55 and 64 are also higher than expected, although not by quite as much as the over 65s.

Actual engagement and expected engagement are almost one-to-one for the 45-54 age group, which is interesting to note as those who fall into this age group are most likely to be obese in the US.

For age groups 35-44, 25-34, and under 25, expected engagement levels are far higher than actual engagement, with 25-34-year-olds showing the biggest disparity. This is surprising as obesity affects 39.8% of adults ages 20 to 39, so the expectation of higher engagement is not without merit.

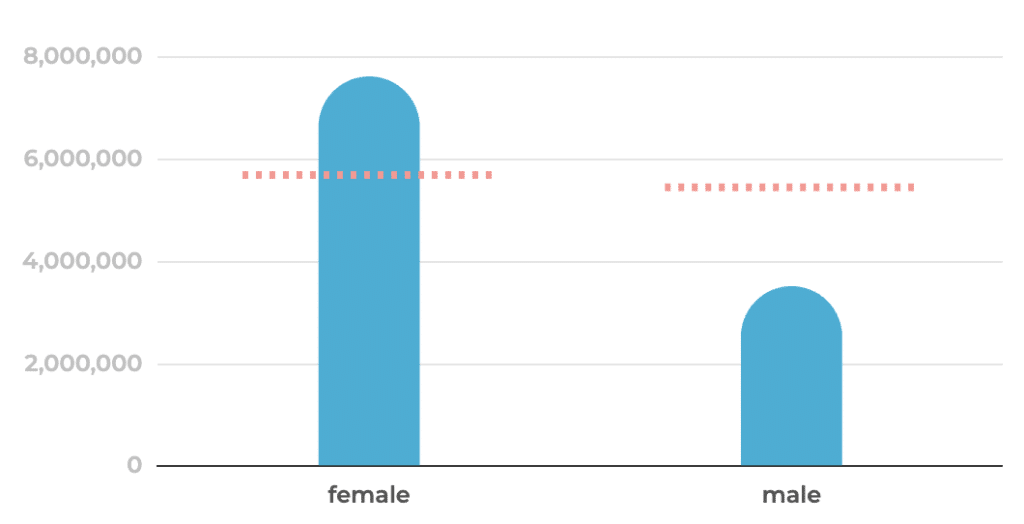

Women Top Men In Ozempic Interest and Engagement

Looking at gender, Polly’s data in the graph below shows exactly who is more engaged in talking about Ozempic online.

Women are in the lead by far, with nearly 800,000 people engaging in conversations online, while men don’t even come in at half that, with under 400,000. Women were also more engaged than expected by around 200,000 more, while expected male engagement was far higher than actual engagement, with also a nearly 200,000 discrepancy.

This gender gap isn’t surprising, as other studies show that while 43% of all women dieted in the last year, only 34% of men did the same. Generally, women are more health and weight-conscious than men, which is also evident here.

A Weighty Debate

It’s clear that Ozempic has burst onto the weight loss scene and attracted a huge amount of engagement online. The drug may only be in its infancy, but it has already made a major impression on people in the US and beyond. Considering that just over 42% of American adults are classified as obese and approximately 30.7% are overweight, a safe drug like this is sure to continue sparking conversations in the foreseeable future.

About The Data

Data was sourced from Polly, who created independent samples of 11,154,381 and 5,168,081 people from Twitter, Reddit and TikTok worldwide over a year until 22 March 2024. Responses were collected and analyzed to produce outcomes within a 90% confidence interval and 5% margin of error. Engagement estimated how many people in the location are participating. Demographics were determined using many features, including name, location and self-disclosed description. Privacy was preserved using k-anonymity and differential privacy. Results are based on what people describe online — questions were not posed to the people in the sample.

Share: